As uplifting and optimistic as the start of a new year can be, for many Americans, it’s often accompanied by more than just fresh resolutions and excitement for the months ahead: it can also bring a significant level of financial stress.

Colloquially referred to as the ‘January debt hangover,’ this period of financial strain often stems from overspending and struggling to balance everyday costs with mounting debt repayments. For some, it means sleepless nights and coffee-fueled mornings, grappling with financial anxiety while trying to regain stability.

Debt-induced stress doesn’t just impact wallets, it can take a toll on mental health, relationships, and long-term financial security. But just which states in the US are feeling the weight of this financial stress the most, and what factors contribute to the variations in debt levels across the country?

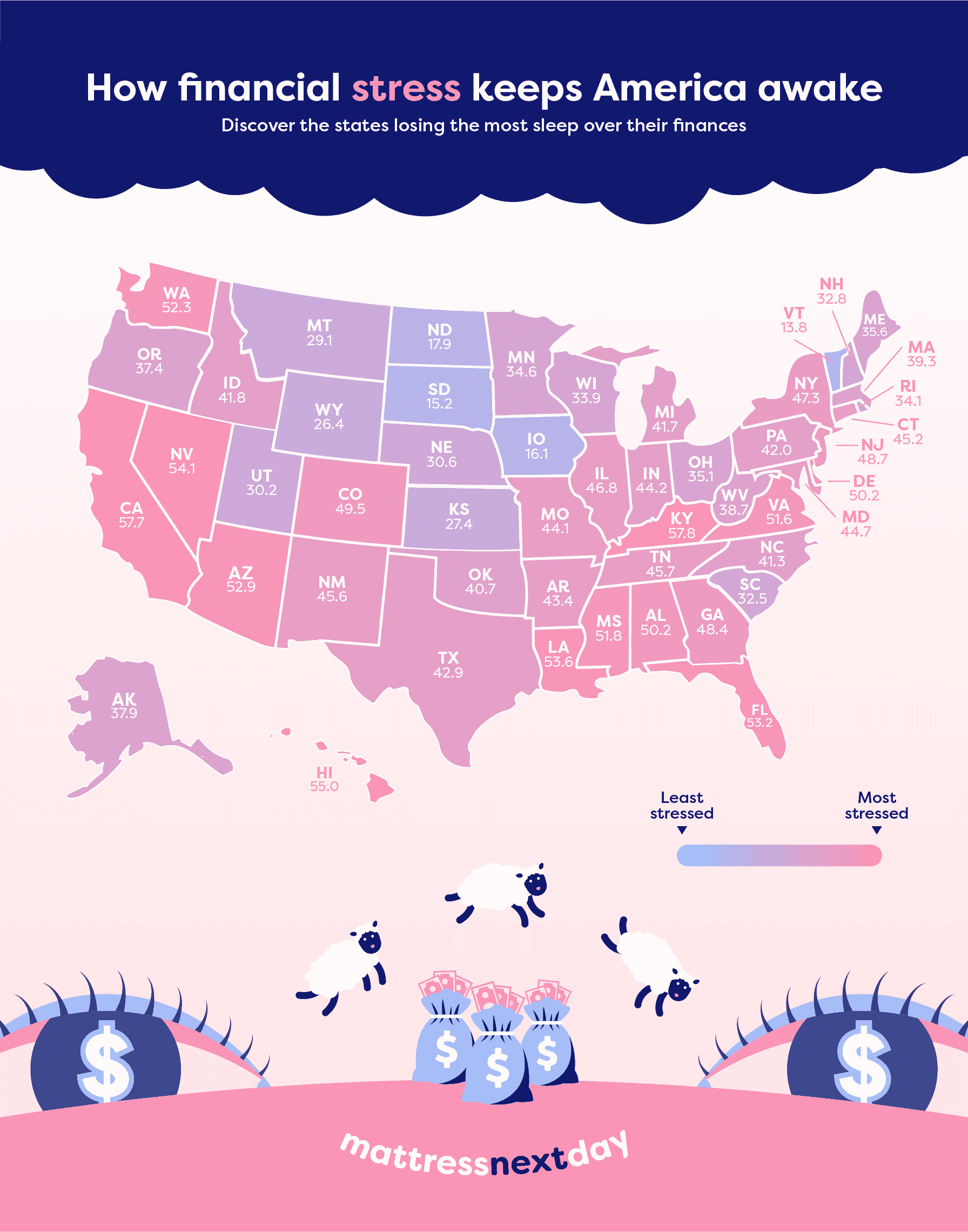

To find out, we created an index analyzing 50 US states on a variety of factors, to see which states came out on top as the most likely to experience sleep troubles over holiday debt.

Not only that, but we also spoke with MattressNextDay’s Senior sleep expert, Martin Seeley, for his top tips on how to better improve your sleep if you’re feeling anxious about debt.

Find out what we uncovered below!

The top 5 US states experiencing finance stress

Ready to find out which US states are losing the most sleep over debt? Here are the top 5 based on our index:

1. Kentucky

Coming in at number one as the state being kept awake the most by the January debt hangover, we have Kentucky, which scored 57.8 out of 100. Despite only boasting a debt-to-income ratio of 1.15 (the amount of debt compared to the average household income), one of the lowest on our list, Kentucky scored very highly in all other areas.

For example, as many as 39.6% of adults get less than 7 hours of sleep each night in this state, the 8th worst overall, while it also placed 5th for unemployment rates at 4.2%. Add to this a bankruptcy rate per 100,000 of 227.8 (the 5th highest again) for an overall population of roughly 4,500,000 and it’s no wonder people in Kentucky are losing sleep over debt.

And the bad news for Kentucky doesn’t end there. It’s also the 5th highest state for US poverty rates at 15.6%, which no doubt compounds the issue of debt further, and with the state’s negative sentiment towards financial stress capping out at 100%, it’s safe to say there’s many a Kentuckian out there who’s anxious about their spending.

2. California

Following on from Kentucky, we have America’s most populous state – California. Home to over 38,900,000 residents, it’s little wonder that California placed so high in our index, settling on a score of 57.66 once all factors were accounted for.

And when we say Californians are losing sleep over financial debts, we mean it! Out of the state’s population, roughly 35.2% of people sleep less than 7 hours each night – that equates to about 13,692,800 people!

And this is just one area that Californians need to be concerned about, as they also came in with a high debt-to-income ratio of 1.66, alongside the second-highest unemployment rate overall (4.8%). Combined with having the 4th highest consumer spending per capita at $64,835, it all makes for a cocktail of financial stress that’s a bitter drink to sip.

3. Hawaii

Turning towards our third-place state, we head away from the American mainland and across the sea to Hawaii. Scoring 55.02 in total, Hawaii has the unenviable position of having the worst levels of sleep in the US, with as many as 45.9% of adults getting less than the recommended amount of sleep each night.

On top of this, Hawaii also placed 1st for debt-to-income ratio at 2.20 – that means individuals in Hawaii could have over double the holiday debt compared to their household income!

As you might imagine, such financial woes have many Hawaiians looking for advice around handling financial stress, with upwards of 14.6 searches being made per 100,000 people. And to cap it off, roughly 67% of Hawaiians have a negative sentiment towards financial stress, which is more than fair given their place in our index.

4. Nevada

Moving to our fourth-place state, we hit the deserts of Nevada, which scored 54.11 overall. Much like Hawaii and California, Nevada places very high for all our index factors, such as coming in 9th for debt-to-income ratio at 1.73, as well as 9th for insufficient sleep, with 39.3% of adults getting less than 7 hours regularly.

But where Nevada really falls short is in its unemployment rate, which tops out our list at 5.1% - no doubt putting pressure on residents when it comes to paying back any debts they may have accrued and likely made worse by the fact that Nevada also came 7th for bankruptcy rate per 100,000 people at 208.7.

Interestingly, however, Nevada placed right at the bottom of our rankings for negative sentiment around financial stress with 0%. This could show that Nevadans aren’t too stressed in general about their levels of holiday debt, or it could just be that they’re too busy trying to level it out to complain about it.

5. Louisiana

Last, but not least, taking the final top five spot for states most stressed about holiday debt, we have Louisiana. Accumulating a total score of 53.63, Louisiana only just skirts into the top five due to being 4th worst for sleep percentage, with 40.5% of its population failing to regularly get a full night’s rest.

But if you think this problem is compounded with Louisiana being number one for poverty rates at 18.9% would put the state higher, you’d be wrong, as Louisiana was surprisingly middle of the table when it came to the other states in our index.

For example, besides Kentucky, Louisiana had one the lowest overall debt-to-income ratios at 1.37, as well as sitting outside the top 10 for unemployment rates at 3.7%. Still, Louisianans are losing sleep for a reason, and it’s certainly possible that holiday debt is playing a role in this.

Tips for getting better sleep with anxiety

In some cases, despite all your careful planning and budgeting, financial strain may simply be unavoidable, but that doesn’t mean you should let such worries interfere with your sleep.

As MattressNextDay sleep expert Martin Seeley points out, there are several important things you can do to help overcome an anxious night’s sleep:

- Go to bed and wake up at the same time – much like budgeting, proper sleep is founded on a good bedtime routine, and that means going to bed and waking up at the same time every day, even on weekends. Doing this will help to settle your circadian rhythm, and you’ll find yourself getting tired at the same time each day, making getting to sleep that much easier.

- Try to exercise during the day – we all know how good exercise is for our bodies, but did you know it can also help you get to sleep in the evenings? For one thing, exercise helps to tire your body out for the evening, but it also causes endorphins to be released, de-stressing your body and alleviating anxiety.

- Avoid napping – while a late afternoon nap might be just the ticket for sleeping off a hearty festive meal, doing so can make it harder to get to sleep in the evening. So, if you can, you should avoid napping during the day. And if you do, you should keep it to 20-30mins max.

- Cut back on caffeine and alcohol – in the same way everyone knows about the benefits of exercise, you’d be hard-pressed to find someone who doesn’t know that caffeine and alcohol can impact sleep. Too much caffeine before bed and you’ll be wide awake well into the morning, while alcohol will simply make what sleep you do get insufficient. So, make sure you don’t drink caffeine after 1 or 2pm, and cut out those regular nightcaps completely.

- Don’t lie in bed if you’re awake – finally, if you find that you’re lying awake 20 minutes or more after going to bed, then the best thing to do is get up and do something calming (but not active or involving screens). Whether this is reading, meditating, or gentle stretching, do something to take your mind off the fact you’re awake and your body will soon start to get tired.

Enjoy great sleep every night with MattressNextDay

So, there you have it, those were the top US states feeling the impact of financial stress.

And, of course, if you want to upgrade your sleeping setup today, then don’t hesitate to browse the MattressNextDay range today. From great deals on budget-friendly bed frames to a variety of flexible divan beds and more, we’re plenty on offer in our collection!

Methodology

This dataset ranks all 50 US states based on how much they’re impacted by "debt hangovers", and how this ties into their sleep quality.

To do this, 8 different factors were used. Once the data for the factors was collected, the factors were then normalized to provide each factor with a score between 0 and 1. If data was not available, a score of 0 was given.

The normalized values were then summed and multiplied by 12.5, to give each state a total score out of 100. The states were then ranked from highest to lowest, based on their total scores.

The factors used are as follows:

- Household debt-to-income ratio – the household debt-to-income ratio in each state, as of Q1 2024. A ratio of 2 indicates household debt is double the income in that state, and a ratio of less than 1 reflects a debt smaller than the income of those households.

- Insufficient sleep – the percentage of adults in each state that get under 7 hours of sleep a day, as of 2022.

- Unemployment rate – the annual unemployment rate in each state as of 2023.

- Consumer spending per Capita – the personal consumption expenditure per capita in each state as of 2023.

- Bankruptcy rate per 100,000 – the number of people filing for personal bankruptcy in each state, as of 2023, per 100,000 people.

- Financial stress searches per 100,000 – the combined number of searches per 100,000 people for the prompts "debt relief", "financial anxiety", "financial help", "money help", and "money problems", in Jan 24.

- Financial stress negative sentiment – using brandwatch and the prompts "money" AND "sleep", we gathered the percentage of posts in each state that have a negative sentiment towards financial stress between 26 Dec 23 - 31 Jan 24.

- Poverty rate – the percentage of each state’s population that sits below the poverty threshold as of 2023.

The factors were indexed as follows:

- All Factors – high values get a high score. Low values get a low score.

All data is correct as of 08/01/25. The ranking data shown is a compilation of multiple data sources and may not be representative of real life. All data is accurate with regard to the sources provided.